Your Guide to the Clean Label Revolution

Filed Under: Best Practices, Market Research

Paul Metz

Chief Executive Officer, C+R Research

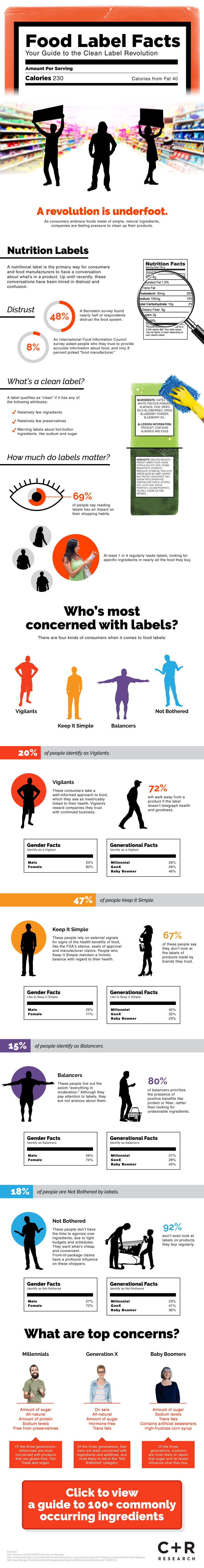

Consumers nationwide are pressuring companies to make products with more simple, natural ingredients. As a result, “clean labels” are becoming more and more common at the supermarket. In the graphic below, we explore the most recent clean label and consumer trends, and share a one-stop shop resource that helps shoppers everywhere quickly get to the bottom of what’s in various products, especially when the labels aren’t clean!

Nutrition labels are the primary vehicle for consumers and food manufacturers to have a conversation about what’s in products. Up until recently, this conversation has been mired in confusion and distrust on the consumers’ end. In a Bernstein survey, 48 percent of consumers said they distrust food labels. In an International Food Information Council survey, when respondents were asked who they trust to provide accurate information about what’s in various food products, only eight percent cited food manufacturers.

So what, exactly, is a clean food label? A clean food label is one that has relatively few ingredients and preservatives, and that provides adequate information about hot button ingredients like sugars and sodium. How much do labels matter? Sixty-nine percent of people we surveyed say reading labels has an impact on their purchase decision, and at least 1 in 4 consumers surveyed read labels regularly, for all the food they buy.

According to our research, there are essentially four archetypes that define how consumers respond to food labels and ingredients: Vigilantes, Balancers, people who want to Keep It Simple, and people who are Not Bothered.

Vigilantes make up 20 percent of consumers and they make a well-informed approach to food, which they consider inextricably linked to their health. These consumers reward companies that make an exemplary effort to change (like Panera Bread or Campbell Soup), with continued business and brand loyalty. Seventy-two percent of Vigilantes will walk away from a product if it doesn’t telegraph health and wellness. This segment is made up of 20 percent men and 80 percent women. Also, 28 percent of Vigilantes are millennials, 26 percent are from Generation X and 46 percent are Baby Boomers.

Keep It Simple consumers make up 47 percent of the market, the largest segment of any persona. These people rely on “signals” more than transparent information on packaging. These signals range from public statements by the FDA to seals of approval and manufacturer claims. Keep It Simple consumers maintain a holistic balance in regards to health. Sixty-seven percent don’t look at labels from brands they trust. Men make up 29 percent of this demographic and women make up 71 percent. Also, 45 percent are millennials, 32 percent are from Gen X and 23 percent are Boomers.

Balancers make up 15 percent of the market. These people live out the axiom, “everything in moderation.” Although they pay attention to labels, they are not anxious about them. Eighty percent of balancers prioritize positive benefits like protein and fiber, working to avoid undesirable ingredients. Twenty-six percent of men are Balancers, compared with 74 percent who are female. Generationally, Balancers shake out to 27 percent millennial, 28 percent Generation X and 45 percent Baby Boomer.

Finally, 18 percent of the market is made up of the Not Bothered segment. Consumers who are Not Bothered don’t have time to agonize over ingredients, usually due to tight budgets and schedules. They purchase what is cheapest and most convenient. Front of package claims have a large influence on these shoppers–92 percent of them aren’t looking at labels on products they purchase regularly. This segment is 27 percent male and 72 percent female. Generationally, Not Bothered consumers are 23 percent millennial, 41 percent Generation X and 36 percent Boomer.

Top concerns about food vary between generations. Millennials are most concerned about levels of sugar and protein, and gluten-free options. Members of Generation X are least concerned with ingredients and additives, and most likely to fall into the Not Bothered category. Baby Boomers are most concerned with sugar, sodium levels, trans fats and artificial sweeteners. Both sugar and fat levels greatly influence what Baby Boomers buy.

explore featured

Case studies