COVID-19 Pandemic: Live Consumer Panel #3 – Five Takeaways

Filed Under: Shopper

Nancy Baum

Vice President, In-Person Qualitative Research

On April 9, 2020, we hosted our third Consumer Roundtable discussion to take a pulse on consumers’ evolving attitudes and behaviors during the coronavirus pandemic. This week, we focused on grocery shopping and how that’s changed for consumers over the last few weeks. As the pandemic continues to evolve and shift, consumers are still figuring out their new routine.

Here are 5 takeaways of what we learned:

1. Shoppers turn to all fulfillment methods but for differing reasons. Similar to what we learned last week, consumers are turning to alternative fulfillment methods to avoid in-store shopping. Some prefer curbside pick-up to have a reason to get outside, while others prefer full delivery for the convenience and ability to avoid contact with others. However, many still find themselves going into stores given the challenges with delivery services. Delivery times have been limited and they aren’t able to get all the items they want. So they are still shopping in-store to get immediate need items.

“For me it’s been getting a defined list, getting in and out and doing as much as possible online. Amazon is my best friend and I didn’t do a lot of that before. They’re always in the neighborhood delivering.”

“We’re buying as many things as we can and rationing so we don’t have to leave as much. Shopping online has been a big thing. I use Instacart because they don’t do Amazon groceries in my neighborhood. But sometimes they don’t have all the things my grocery store does.”

“We’ve used Target deliveries. They all have different things. If we have to go into the store it’s non-peak times.”

“Our choice [between curbside or delivery] is based on needs. I’m out and about all the time. If I can shop for something I will. If I’m at work and we need something we’ll do an online thing. Or if I’m pressed for time it’s easier to do curbside, I can just show up and drive off.”

2. Retailer choice is now also driven by shopper traffic and item availability. While many still have their preferred grocery store(s), their choice on where to go now includes their understanding of how busy the store will be and what’s available. Some are choosing smaller format stores because they are limiting the number of shoppers in the store at a time. Others are choosing larger stores that they are now finding are more consistently in stock. Consumers are having to vary where they shop too to complete their list given the prevalence of out of stocks.

“Instacart told me it’d be a week before I could get my groceries, so I went myself. I waited 30 minutes to just get into the store. I typically go to Aldi’s because it’s close. Not too many people go there where I live. You’re not waiting as long. When I drove by, I saw the line. When I parked the car they said they were only letting in 2 people at a time.”

“The bigger box store’s [shelves] are empty. You go to stores people don’t shop and you do better. If I go to ShopRite or Redner’s, they’re stocked more.”

“We know already who is out of what. We write on paper what we need. We do online ordering first then we go pick up the main items. It’s only been a few weeks of this; I think it’ll adjust again in a few weeks depending on how things go.”

3. Brand selection for many items is down to what’s available in many categories. Consumers are choosing what’s available vs. their preferred brand, especially in necessity categories (e.g., milk, eggs, fresh meat, paper products). This may lead them to pay a premium or trade down a purchase an item that doesn’t satisfy. And it does not necessarily equate to a new loyal customer, yet.

“If organic is all that’s available I’ll choke and buy it. I don’t typically buy it.”

“We’ve been having a tough time getting hold of [our preferred brands]. We have to go to name brand cereals. Instead of paying $1.50 we’re spending $3-4 a box. We’ve been forced to change.”

“We got something I thought was a tortilla chip because the pretzels were gone. I thought we’d try something new. Every time we go shopping, we get something new. Right now it’s the norm to get new things. We got this cracker that tasted like an MRE [Meal, Ready-to-eat] to me.”

4. Children’s picky palates make it difficult to substitute some of their favorites. In addition, kids have specific tastes that parents are unable to fulfill now because of lack of availability. They have preferences for specific brands and flavors, and parents are having a difficult time finding acceptable substitutes, so they are forgoing the product altogether.

“Peanut butter. I’ll eat either kind [creamy or chunky] but as far as my daughter, she likes a little spoonful but the chunky is all they have. They smooth is always gone. So right now, no one’s eating peanut butter.”

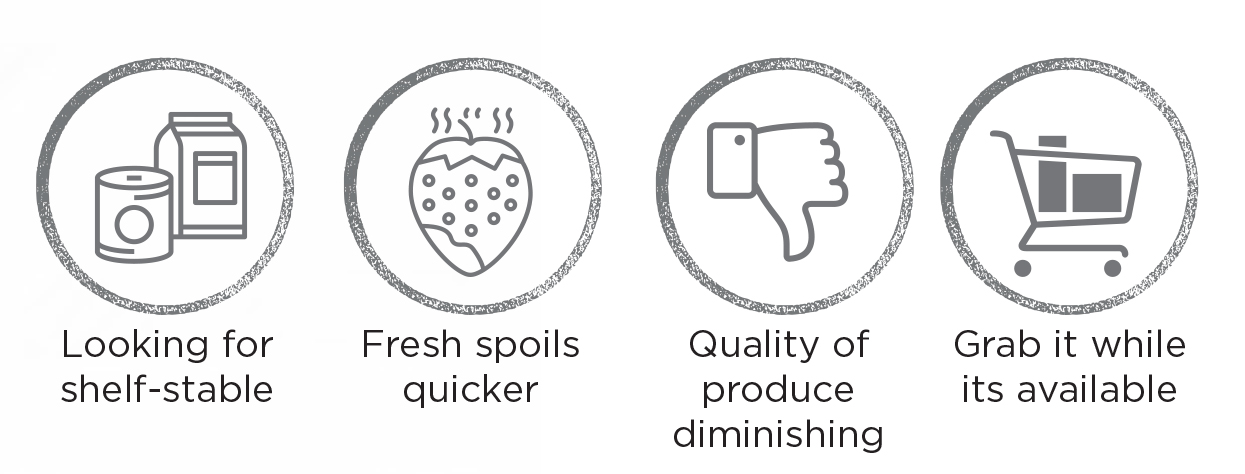

5. Many are switching to more shelf-stable items to stockpile and help limit the need to shop often. Again, consumers are trying to visit stores less often than what they used to do. Fresh spoils more quickly – so then they have to go back to the store sooner. Some are also noticing the quality of produce diminishing in their preferred grocery store because they are ordering from different vendors; some are also being limited on the amount of fresh meats, produce or dairy they can purchase. So they are looking for shelf-stable alternatives in the center aisle as a replacement that keeps them from coming to the store too often and to keep things on hand to be prepared for future out-of-stocks.

Consumers wished they would have stocked up more had they known how difficult it would be to get groceries, and the sporadic availability of items is further encouraging them to “grab it while they can.” While there are conflicted feelings on with stocking up – on the one hand, consumers understand this is what has caused a strain on the supply chain, on the other hand, they are now running low on pantry items they come to expect to always have on hand. Even still, others feel they wouldn’t have done anything differently because there’s bound to be hardships and changes in one’s routine during a national emergency.

“We get a lot of freeze-dried fruits, apples, strawberries, mangos. The kids like them. That was one way to combat the lack of supply.”

“We bought Ovaltine and Ensure in case milk got so low, I can mix that with water for our 3 yr old. No one’s buying a lot of Ovaltine right now.”

“We have [produce available] but the quality for some aren’t good. For others it’s the same. Cilantro was very wet. All of it was soaked. Some of those types of vegetables, the cilantro, green onions, leafier stuff is worse. But most fruits are ok.”

“I would have built a stockpile of cleaning supplies and dry ingredients, non-perishable goods.”

“I don’t know. It’s hard to say because a few weeks ago who would have known people would hoard toilet paper? People were just buying based on what they thought they might need and not what they actually needed. It wouldn’t have changed anything for me. Anything I need immediately I can reach out to friends and get something if I absolutely need it. None of my shopping behavior would have changed.”

“I don’t think I’d change much because it’s the nature of the beast. We keep a good plan. We stock up on diapers and wipes, so I’ll need a plan for that in a few months. We haven’t had to touch that stock yet though.”

C+R’s take:

- Create a Seamless Omnichannel Experience to Keep Consumers Informed Before Shopping: Consider ways to help shoppers navigate whether in-store shopping or online ordering is best at the time that they need groceries. Alerting consumers of available delivery times and the available inventory in your app or on your website can help them better prepare.

- Help Shoppers Navigate, Create In-Store Solutions for Current Stock: Consumers are still adjusting to the changes in their routine and the availability of grocery items. How can grocery retailers and manufacturers help them navigate at-shelf in this new landscape of varying inventory and availability of unfamiliar products?

- Educate on Ways to Use Your Brand/Product for those less familiar: This a ripe time to covert new customers to your brand. How can CPG manufacturers help consumers find creative ways to utilize the new food products they are trying for the first time? How can companies maintain these new purchasers after the supply chain has returned to normal again?

Click here to download the 5-Takeaways infographic!

Click here to read about our Five Takeaways from our first live consumer panel!

Curious to hear more? We’re hosting another consumer panel focused on the impact on the family on Thursday, April 23 at 12pm Central. Sign up here.

explore featured

Case studies