Case Study

Agile Qual-Quant Guides Portfolio Expansion

overview

Our client, a large consumer package goods (CPG) beverage manufacturer was interested in expanding their product portfolio, but needed to understand the viability of the idea – would consumers be interested in the new product? And if so, which positioning/product name/packaging resonated with them the most?

Because launching a new product to a brand’s portfolio is such a large investment, our client needed the confidence of robust, quantitative sampling. At the same time, they needed to dig deeply into the why’s behind consumers’ preferences and attitudes – best accomplished through qualitative probing. And, like most businesses operating in a fast-paced, competitive environment, they needed their insights quickly.

THE PROBLEM

Need Quant Scale Reliability with Deep Understanding of the Why’s

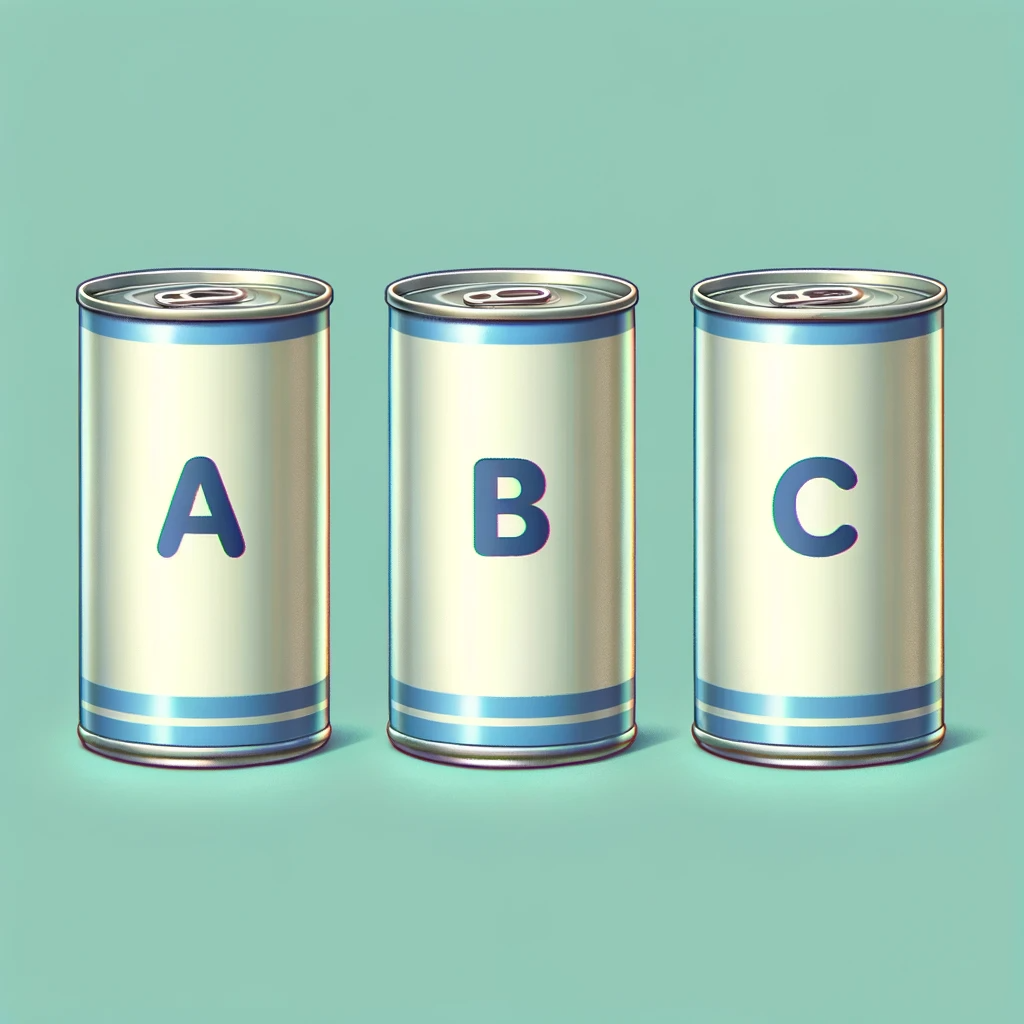

Our client, a well-known beverage company, had developed an idea for expanding its product portfolio and wanted to understand if the idea had potential. To help consumers understand the concept, three different positionings were created, accompanied by a specific name for the product. To bring the concepts to life, each was presented in respective packaging, which was also evaluated.

The brand approached C+R for help in testing this idea. They wanted a robust sample of respondents so they could feel confident about the results. However, because there were so many dimensions that were being tested, they also needed in-depth understanding to determine what exactly was driving attitudes toward the concepts.

Based on the client’s objectives, we knew that our LiveHIVE approach was the perfect solution.

the solution

LiveHIVE – an agile qual/quant hybrid method – providing results in real time

We implemented our LiveHIVE methodology, a dynamic research solution that integrates real-time quantitative results with online moderation. LiveHIVE empowers our clients to access immediate answers to critical questions by observing the data as it is collected.

Throughout multiple sessions, our team at C+R facilitated group discussions with the client team to analyze the quantitative data as it came in. From there, we selected six participants from each quantitative session to partake in webcam focus groups, where C+R acted as the moderator for each 60-minute session. The client team observed these focus groups through a backroom video feed.

Following the initial session, we collaborated with the client team to discuss the findings and refine the focus group structure, if necessary, before proceeding to the next session. After the final session, we held an extensive debriefing session with the client team to synthesize all the insights gathered and identify the positioning, product name, and package design that showed the most promise – albeit with some optimizing prior to launching the new product.

The result

Real-time results lead to quick optimizations for the next round of testing

Based on our LiveHIVE sessions, all three of the concepts performed strongly and similarly. However, each product name connotes a different meaning, and it is important for the client team to determine the impression they want consumers to have and the need states it will meet. In addition, it will be very important that the overall brand name be clearly communicated on the package as it will help build trust and interest in the product, given its strong brand equity.

The feedback from the sessions also indicated some watch outs for the packaging – specifically, the unique ingredients that differentiated the product were not familiar to consumers, causing confusion. The recommended direction was to focus on the benefits of these ingredients, rather than the names themselves.

Taking all this information into consideration, the client team moved quickly to get the optimization ready for another round of testing.

proven experience

related case studies