B2B Market Research: Unique Challenges & Solutions

marketing to businesses

Compared to consumer marketing (B2C), marketing to businesses (B2B) presents unique challenges. For one thing, you must conduct research and analyze findings within the framework of a specific business context, considering both company and industry-specific issues and drivers.

Additionally, the respondents best able to impart important insights are busy executives and business professionals who may, depending on the topic, have little intrinsic motivation to share their expertise with you.

contributors to this guide

Alex Palermo

Senior Vice President, B2B Research

C+R’s custom-tailored research solutions and whatever-it-takes philosophy allow us to help you to successfully meet these B2B challenges. We have experience reaching a variety of business customer segments in an array of diverse industries, including:

No matter the industry or business segment, we approach B2B research through the lens of an ‘objective outsider.’ While we understand a range of industries at a high level and are experts at diving deeply into specific fields and problems, we’re not mired in the intricacies of any one industry or company. This objectivity means that we won’t overlook insights that will address your most important business objectives. We know how to defer to respondents as experts, to pause and ask seemingly silly questions to attain clarity.

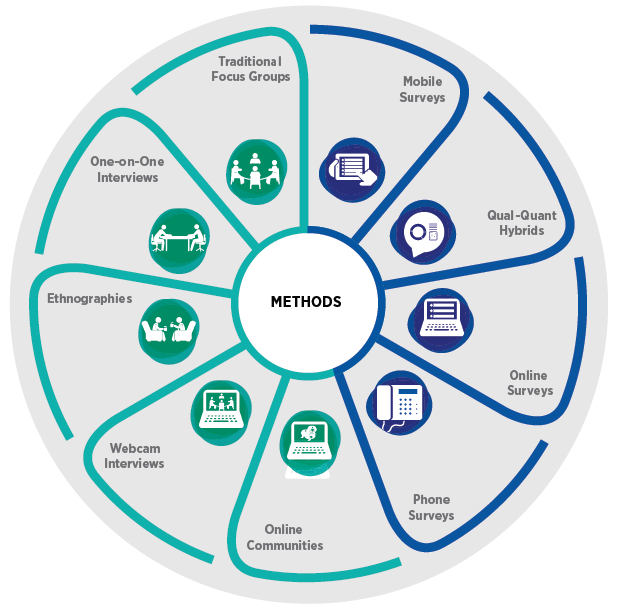

Our B2B experts are thought leaders in a wide range of both qualitative and quantitative methodologies, from complex segmentations and market landscape analyses to positioning and innovation—and everything in between! The chart below outlines the many methodologies we’ve successfully deployed in B2B research; read further for deep dives into specific methods we’ve used to reach B2B audiences.

our breadth of methodologies

qualitative

Providing insightful research through superior execution and expert qualitative analyses by knowledgeable and experienced people who are intimately familiar with a client’s industry.

quantitative

Our B2B experts deliver powerful quantitative analyses and insights our clients can leverage to build strong brands, successful products and services, and powerful communications.

qualitative research with b2b audiences

Qualitative methodologies involve smaller-scale samples (vs. quantitative) and seek to address the base attitudes, behaviors, needs, and motivations of business professionals in the context of their jobs and industries. Akin to B2C, qualitative in the B2B world seeks to answer why professionals think or do what they do and how that impacts their business.

in-depth interviews

C+R frequently leverages in-depth interviews (IDIs) with B2B respondents, which can occur via webcam or telephone or in person.

Webcam IDIs are extremely convenient for busy professionals and allow C+R to meet these respondents in a convenient way, oftentimes on their own “turf.” Frequently these interviews are conducted right from the job site and last 45–60 minutes each. As such, they are efficient in terms of time management for respondents and for the researchers and clients. Webcams enable researchers to gain the valuable context of nonverbal communication, which can be important in understanding reactions to more sensitive topics or concepts.

C+R conducted webcam interviews with food service buyers to understand the nature of the distributors and retailers they used, the shopping process, purchasing dynamics, and which retailers were better at delivering on buyers’ needs. As part of the study, the respondents shared their screen to show us their shopping process so we could observe their behaviors and decision-making in the moment.

Sometimes B2B professionals are reluctant to use webcams, in which case a traditional telephone call works well. Telephone IDIs feel quite natural to busy professionals and enable a greater degree of anonymity that allows them to be more relaxed and candid in their responses. For both webcam and telephone IDIs, an online portal can be leveraged to show stimuli and enable clients to communicate and send notes to the moderator in real-time.

Finally, in some instances, it may be appropriate to engage professionals in a one-on-one capacity in person. This can be challenging, as professionals are busy people, but in situations where the objective is to understand a process more holistically and/or to show and get reactions to stimuli, engaging professionals in a conversation in person can be invaluable. For example, C+R researchers and their clients attended one of the largest farming shows in the country, the Nebraska Farming Power Show.

Farmer respondents were intercepted at the client’s booth and asked to participate in in-depth interviews (IDIs) at the show. Farmers were asked to articulate problem areas, pain points, and unmet needs around cleaning, lubricating, and protecting farming machinery and working components. They highlighted these problem areas by showing us chains, joints, and couplings on existing machinery at the show. They were then shown new product concepts or ideas that corresponded to these problem areas, and asked for their reactions, including appeal, relevance/usage, differentiation, brand fit, and optimization. These in-context IDIs gave us richer insights and feedback than we would have generated in a webcam interview or focus group facility.

focus groups

Focus groups are an efficient way to engage with a larger number of respondents than is possible with one-on-one sessions, and they also offer the benefit of being in person. This provides the ability to get hands-on with stimuli, such as to test a new prototype, and the moderator can better observe facial expressions and body language to gain a nuanced understanding of respondents’ reactions and feelings.

Group settings also enable social dynamics, where respondents can build on one another’s responses to take the conversation to a deeper level. This is valuable when exploring perceptions related to the category or brands within it. Smaller groups, such as dyads and triads, are beneficial when both the social interplay and the ability to probe deeply are desired. Larger groups, typical of consumer-focused research, also work well in the B2B area. Respondents may share the same industry or work across industries but have some other factor in common, such as using the same tool or product.

For a recent project focused on developing a new positioning for a web conferencing software, we talked with decision-makers from a range of industries. While their jobs were different, the respondents were able to share similar experiences, needs, and frustrations as they talked about conferencing platforms and how these systems impacted work life.

We used a metaphor elicitation technique to understand the drivers, barriers, and emotional connections business consumers had to the various options in the marketplace. Our client then used these insights to craft positionings that resonated with their customers and appealed to prospects.

Being in a traditional focus group setting also provides internal advantages. For some clients, their culture thrives on the backroom debriefs that happen during the fieldwork period. They can gain alignment more quickly and easily, and they can iteratively optimize stimuli as we progress through the research.

onsite observation

For some projects, it’s more important to understand the holistic context of the respondent and their job. Sometimes we go onsite to interview and observe respondents in their work environment.

This method can be used to uncover the current processes in place, to test new equipment, or to observe the interactions of the employees and the various roles and needs of each position.

The focus may be solely on the employees, or it can involve the dynamics of the customers, workers, and physical space.

ONLINE

Online research communities are also feasible in the B2B space. As with consumer-focused research, the remote and asynchronous nature allows us to immerse ourselves in the respondent’s world on their terms. We can understand their day-to-day needs, behaviors, and pain points in the moment.

We are mindful of potential sensitivities, reminding them to maintain the confidentiality of their customers. Despite the confidentiality protocols, they are able to share quite a bit. For instance, in a project with nurses, we used an asynchronous online community to learn about their day-to-day

responsibilities, the flow of their shifts, and their highs and lows throughout the day (or night). This provided behind-the-scenes access that wouldn’t have been possible in a more traditional facility setting. It also fit conveniently into their shift work.

QUANTITATIVE RESEARCH WITH B2B AUDIENCES

Qualitative research can be a good first step or it can be the end game. However, in many cases—once qualitative research is completed—our clients ask us, “How can I generalize these results to my entire customer base using statistically sound data?” That is where quantitative research comes in.

To be sure, quantitative research with B2B audiences is quite different from traditional consumer research. There are many differences in how we would approach a B2B survey, not the least of which is the sampling framework. Here are some rules of thumb and best practices that we have learned along the way.

THIRD-PARTY SAMPLE VS. INTERNAL CLIENT LISTS

Depending on the topic of the study (for example awareness and usage or brand health tracking) we may need to use third-party sample to provide an unbiased look at the whole customer and non-customer universe.

If however the study involves specific targeted questions with an existing or lapsed customer base (for example customer satisfaction concept testing or pricing studies) then we would recommend recruiting from internal list sources to start—and potentially supplementing with third-party sources down the road. While this also applies to qualitative recruits, the sample sizes required in quantitative research means this is even more important.

when recruiting from third-party sample suppliers:

- Be clear. Make sure the screener questions are clearly worded in language that the target audience will understand (including definitions of any obscure industry terms that may confuse respondents).

- Show and tell. Include images in the screener whenever possible to aid in recognition/recall if you are looking for niche users of a particular product.

- Trust your suppliers. Use a sample supplier that specializes in the industry that you are targeting. C+R does not manage in-house panels. Instead, we partner with the right suppliers tailored to each topic, industry, and client that we serve. We trust that these suppliers fully vet their lists and continuously scrub them to keep them up to date and we have stringent internal data quality measures to ensure this.

- Be vigilant. Continuously monitor the field period to ensure you have the right respondents in your sample. Pivot when needed. For example, in a recent study for the utilities industry, we found that most of our small-business-owner sample was terminating at the industry question because they were typing in “other, specify” responses. After a few days in field, we decided to adjust the industry question to ask it open-endedly and allow all responses to be coded on the back end. This change not only increased our incidence, it also helped the client identify who specifically was represented in their small business sample at a more granular level.

when recruiting from internal client lists:

- Give respondents a heads up. You know how when someone texts you ahead of time, you are more likely to respond “yes” to their event when you receive the invitation? Well, B2B respondents are no different. In fact, we have seen a drastic improvement in our response rates (upwards of 10%) when contacts are pre-alerted from someone from their organization.

- Keep it consistent. The message that comes from the internal spokesperson should mirror the message in the survey invite and vice-versa. Wording and branding should be consistent across emails.

- Earn their trust. Often, our clients will include the name of a contact person from their organization in the actual survey invite. This helps engender trust that the survey is actually sponsored by the client organization and is not a scam or clickbait. We also encourage the use of logos (ours and our clients’), as well as information on how to learn more about C+R Research and how to opt out of the research study.

- Offer the right incentives. You know your audience even better than we do. Sometimes it’s worth it to offer them a high-value monetary incentive if we feel this is what will be most motivating. In some cases, monetary incentives are prohibited by the respondent’s employer or by our client. In those instances, we would offer a sanitized shareout of the results (via a one-pager or executive summary deck) if we feel the results of the study could provide value to the respondent and their business. Donations to charity are also a valid option in B2B studies where monetary incentives cannot be offered.

RE-THINK YOUR EXPECTATIONS

If you have mostly been exposed to consumer studies in the past, working on quantitative B2B research may reshape your perceptions of what quantitative research can look like. Many of our consumer surveys are fielded in a matter of days, yielding sample sizes upwards of 1000. That is simply not the case with B2B studies, and we recommend adjusting expectations accordingly. Timelines may grow and sample sizes may shrink, but what does not waiver is the quality of the result.

Here are a few ways you may need to rethink expectations when working on B2B quantitative studies:

- Learning curves. Expect that all new projects should start with a kickoff meeting to share your industry knowledge with the vendor and to field questions that will help make the research a success.

- Lengthy field periods. Depending on the incidence of the B2B respondent target you are trying to reach, the time of year, and the desired sample size, expect the typical B2B field period to be about twice as long as a traditional consumer study.

- Smaller Sample sizes. Don’t cringe! But yes, we do think it’s OK to analyze a sample of 40-50 respondents. The acceptable sample size has a lot to do with the size of the population at large. Take, for example, our healthcare industry clients who only serve certain markets. If we talk to 12 neurologists and 28 personal care physicians (PCPs) in a tristate area, we have essentially covered a large enough portion of the population to generalize the results.

MAKE IT ENGAGING

Nobody likes to be bored—and that especially goes for your busy and highly valuable B2B respondents. If we send them a survey link that is mobile friendly and contains drag-and-drop questions and logos/imagery, they are much more likely to complete it than if we send them a lengthy survey full of grid questions that need to be completed on a PC. Your B2B clients are on the move just as much as you are. It’s critical that we meet respondents where they are with technology and keep our surveys as simple, fun, and easy to complete as possible.

CLOSING

Although B2B research may take some extra effort compared with B2C, the insights to be gained are more than worth it. But you don’t have to go it alone! C+R is deeply committed to helping you meet the challenges of B2B research regardless of the industry, respondent segment, or methodology. Contact us for a customized B2B research plan that will help you connect with your business customers and drive your business objectives forward.

Alex Palermo

Senior Vice President, B2B Research