Shopper Research:

Adapting to a Post-COVID Marketplace

contributors to this guide

Erin Barber

President + Chief Client Officer, C+R Research

Terrie Wendricks

INTRODUCTION

The COVID-19 pandemic has radically changed the way Americans shop. Shortages in popular and essential products like toilet paper, hand sanitizer, and canned food drove many to try new brands and stores. Lines and social distancing restrictions led some who generally visit multiple locations to opt for one-stop shopping. And the number of consumers shopping online rose significantly; some estimate that COVID-19 accelerated the growth of e-commerce by four to six years.

To accommodate these ever-shifting shopping dynamics and remain salient in the minds of consumers, brands had to shift business objectives – even as budgets were tightened amid uncertainty over the future. When the pandemic began, companies faced swiftly evolving trends in shopper behaviors and many questions arose, including:

- When do shoppers choose in-store shopping, and when

do they go online? - How can companies reach shoppers across these

different platforms to remind them of favorite brands,

especially when these brands have been missing from

shelves due to shortages? - How have shoppers dealt with product shortages?

shopper-focused research

Making things more challenging is that the answers to these important questions were fluid, often shifting as the pandemic entered different phases.

To discern the new shopping trends an answer these (and other) important questions, our clients turned to C+R seeking shopper-focused market research. Many of our tried- and-true methodologies (both quant and qual) worked as they had pre-pandemic; however, others evolved to better reach consumers amid their new locked down lives. This was especially the case for our qualitative practice as the pandemic required us to deepen our experience with digital tools and develop innovative new ways to transition some traditionally in-person qualitative methodologies into the online space.

shopper research during covid:

three trends

Shoppers’ habits have changed over the past year in three key areas:

- Categories purchased

- An increased concern with safety, as well as health and

wellness - The meteoric rise in the use of e-commerce

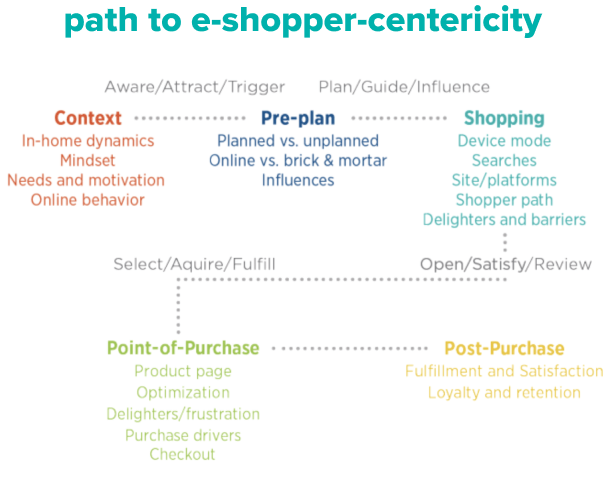

Therefore, we focused our shopper research offerings on addressing these trends, but always grounded ourselves in our omnichannel shopper framework.

This framework is founded on a few important precepts:

- Who a consumer is as a person and their life events has

an impact on the path they take. - The path is not necessarily linear. While decisions in one

phase may direct steps in subsequent phases, they may

also cause shoppers to regroup and go back to the prior

step. - It is an omnichannel world, with shoppers seamlessly

moving between digital and brick and mortar.

Categories Purchased

With many consumers spending more time at home during the pandemic, the demand for certain types of products grew. For example, those who were primarily dining out for their meals sought solutions to help them prepare and store meals at home. As a result, frozen and other pre-prepared foods, as well as food storage solutions, grew in importance.

This increased demand changed things for retailers as well. Prior to COVID-19, retailers relied heavily on Just-in-Time inventory, a management method that seeks to reduce inventory costs by acquiring goods only when they are needed; stockpiling items is discouraged. Therefore, when the mandated lockdown occurred—sending millions to the grocery stores to stock up—many popular items (as well as many not-so-popular items) quickly disappeared. Retailers simply did not have enough product on hand to meet the sudden and immediate consumer demand.

Once these supply chain issues began to resolve, CPG manufacturers in these in-demand categories turned to market research to help them find ways to court new shoppers and, importantly, to retain them once the pandemic ends. For example, a frozen foods manufacturer saw an opportunity amidst the pandemic to grow their business in club and dollar stores and wanted to understand what was driving the purchase of frozen foods in these channels. Specifically, they wanted to know what, beyond price, consumers considered to be a ‘value’ in the frozen food category. To answer this, C+R created a robust shopper research study using both qualitative and quantitative methods. Webcam interviews and online surveys with frozen food purchasers who shop at dollar and club stores helped our client to discover the common drivers and barriers to shopping the category at these stores. It also allowed them to map the full shopper journey through the frozen food category, helping them to develop customized shopper marketing plans for each channel. Finally, our analysis highlighted opportunities for our client to drive retention of new category buyers beyond COVID through assortment optimization, merchandising refinement, and category innovation.

In another example, a food storage solutions client turned to C+R for help in understanding the increase in plastic bag usage during COVID. The client needed insights to help them better understand what consumers wanted in plastic bag storage solutions and how to extend consumers’ purchase and use of these items beyond the pandemic. To answer these questions, we paired shopper research with an Attitude & Usage (A&U) study. We surveyed shoppers whopurchased plastic food storage bags to learn:

- How often they buy the category

- What sizes of bags they use most often

- Their perceptions of key brands in the space

- The extent that concern for sustainability and

environmental issues affected their use of the

products

We learned that some of the shoppers’ reasons for purchase, though initiated or heightened due to COVID, are likely here to stay post-pandemic meaning our client has an opportunity to innovate in the category and win these shoppers over to their brand.

increased concern with health/wellness and

safety

During COVID, the desire to reduce the spread of the virus brought into focus the safety of consumer products as they travel along the supply chain from manufacturer to retailer. Customers have become much more attuned to how far the products they purchase have to travel, as well as how many different hands touch those products. Subsequently, brands have had to prove they are doing all they can to ensure the safety of their workers, products, and the consumers themselves from assembly line to store shelf.

Additionally, COVID-19 accelerated a trend that’s been on the trends lists for years: consumers’ desire for products that promote health and wellness. Although the use of products with health-based claims such as ‘organic,’ ‘plant-based,’ and ‘better-for-you’—as well as vitamins and supplements— showed increases prior to 2020, the pandemic spurred unprecedented sales and demand for products in the health and wellness space. Brands, in turn, have turned to market research to develop understanding of these increased demands so they can offer shoppers solutions.

In this example, a CPG client hoped to capitalize on shoppers’ increased demand for healthier meal solutions and meet growth expectations by identifying and better understanding the consumers of their natural and organic packaged meat offerings. To help them with this, C+R used a multi-phase quantitative research program. First, we used behavioral analysis to better understand consumers’ purchasing behaviors of packaged meat, including any differences between natural/organic meat and non-organic. A quantitative survey was then deployed to create an attitudinal consumer segmentation and to confirm and further refine the packaged meat behaviors uncovered during the first phase. We discovered that, in regards to consumer behaviors during the COVID-19 pandemic, new consumers had shifted to buying organic and natural packaged meat in hopes of finding quick and easy meal solutions they can feel good about eating and serving to their families.

Another client, a manufacturer of vitamin and supplement products, sought to understand how consumers were shopping for immunity products – specifically, how shoppers decide what products to buy and use and what behaviors, if any, had changed due to the pandemic. To answer these questions, we created a multi-phase research project. Qualitatively, an online community and remote shop- alongs (instead of in-person shop-alongs due to COVID-19 restrictions) helped us glean that although consumers didn’t switch brands or the amount of immunity products they were buying and using, there were some changes. Some shoppers reported using these products more often in an attempt to prevent contracting COVID, while others shopped more online due to reduced inventory and/or a desire to reduce their risk of infection. A subsequent quantitative survey built a decision tree for how consumers purchase these products and used a discrete choice analysis to rank the importance of the various features of immunity products.

rise in-ecommerce

While the number of consumers shopping online has been growing for several years now, COVID-19, as mentioned earlier, accelerated this growth by several years. Shoppers faced with various lockdowns and the absence of preferred products on the shelves of brick-and-mortar stores turned more often to online merchandisers for desired products. Companies, in turn, sought to gain greater insight into how to reach these consumers in online spaces and sway them toward purchasing their brands.

While the number of consumers shopping online has been growing for several years now, COVID-19, as mentioned earlier, accelerated this growth by several years. Shoppers faced with various lockdowns and the absence of preferred products on the shelves of brick-and-mortar stores turned more often to online merchandisers for desired products. Companies, in turn, sought to gain greater insight into how to reach these consumers in online spaces and sway them toward purchasing their brands.

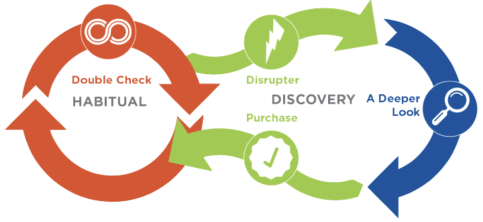

C+R uses its omni channel framework to map shopper journeys: two paths are illustrated below. One path is more habitual while the other is more of a shopper in discovery mode. This framework helps clients to not only understand shoppers’ behaviors and the whys behind those behaviors, but also the pivotal moments in these journeys to ensure a relevant, easy, and engaging experience for the shopper. In this framework, COVID-19 and the associated lockdowns, supply chain issues, and social distancing requirements would be considered a disruptor prompting a deeper look into shoppers’ purchasing behaviors, including those who migrated online.

For example, a manufacturer of bathroom and cabinet hardware turned to C+R for help in understanding how pros and consumers intending to purchase in their category might do so online. The client faced a challenge in that traditionally, this category requires the ability for shoppers to touch and feel products before committing to purchase. Because more consumers were willing to purchase online during COVID-19, the client was hopeful this barrier could be overcome. We conducted a two-step research program; in the first phase, qualitative webcam interviews with pros (e.g., contractors) and DIYers were conducted to determine their typical shopping process and to watch them navigate various websites for cabinet and bathroom hardware. In the second phase, we administered a quantitative survey to validate hypotheses and come up with solutions to issues raised during the qualitative phase. Our client gained a broader understanding of how pros and consumers shop the category online and received suggestions to optimize the experience, including offering a best-in class experience while minimizing barriers to clicking “buy”.

Virtual Shelf Sets

Despite the pandemic (or perhaps because of it, given early supply chain issues), retailers still want to offer shoppers the best mix of products in the most ideal locations on shelf. Brands also need to know how well their products stand out on shelf. To answer such questions, consumers generally meet with researchers in person and view mock shelf sets. However, due to the inability to conduct in-person research, the use of, and reliance on, virtual shelf sets grew.

Virtual shelf sets can mimic a brick-and-mortar store’s set up, allowing participants to “shop” the store similarly to how they might do so in person. Using 2D and 3D models, researchers create a store environment where participants can navigate around to view products. Clicking on the images allows participants to take a closer look, or even to indicate purchase intent. Virtual shelf sets are often used in conjunction with interactive surveys, which aid in helping the participant feel like they are actually in a traditional store.

C+R used this virtual shelf set/interactive survey combination to help a major office supply company gauge shoppers’ reactions to a proposed packaging design change. Our client also wanted to know if the new design would successfully communicate important product claims to consumers. We leveraged an interactive survey that allowed participants to ‘shop’ one of two virtual shelf sets. This interactive survey also had advanced functionality for analysis that allowed the research team to track the number of minutes it took for category shoppers to shop the shelf and correctly find an item.

This innovative approach enabled us to deeply analyze shoppers’ attitudes, coupled with the findability results to provide the client with the recommendation to move forward with the new packaging given the incremental revenue, findability, and ability to clearly communicate product benefits.

Virtual shelf sets also proved useful for qualitative shopper research. As an example, we helped a cleaning supplies company assess how shoppers’ perceptions of their products shifted during COVID-19. Due to limited in-store supplies in this category (causing abnormally bare shelves) and social distancing restrictions, we created an online community incorporating a virtual shelf set shopping activity. Using a 2D planogram modeled closely on how shelves would look in store, we screen-recorded shoppers browsing and shopping the virtual shelf set, which included 4-5 rows of front product facings with prices listed under each item. With this tool, we were able to get our client

the answers they needed while keeping consumers safe. Additionally, participants enjoyed the shelf set activity as it was something they could do from the comfort and safety of home and because it helped them to avoid the typical hassles of product non availability, reduced store hours, mask-wearing, and screaming kids.

Shopper Research in a Post-COVID World:

Introducing Illuminator® Shopper

Panel Powered by Prodege

As vaccines become widely distributed and cities across the country begin to reopen, trends in shopper research will undoubtedly shift again. While we expect the macro trends of increased e-commerce and a focus on health and wellness to continue (as they were growing trends pre-COVID), only time will tell if brands can retain and even grow—the customer bases they gained via pandemic shortages and items needed for prolonged periods at home. Whatever happens, C+R will continue to help our clients track these post COVID shopper trends, using both new and traditional qualitative and quantitative methods. C+R’s Illuminator® Solutions leverage our many years of shopper insights expertise and our vast toolbox of qualitative and quantitative research knowledge, along with verified shopper behavior to illuminate the most actionable insights to address our clients’ category, brand, channel/ retail and shopper business issues. At the heart of C+R’s Illuminator® Solutions is our Shopper Panel powered by Prodege, a consumer engagement platform with millions of verified members with proven spending histories.

This panel provides insights into the behavior of verified shoppers via receipt, location, and digital data sample for our custom shopper insights solutions. This gives us access to numerous ways to define your shoppers of interest based on actual behavior, online and offline via: Hundreds of thousands of shoppers who upload receipts, location-based research (geolocation), and online/digital metering. The true benefit of this is that we do not need to rely on claimed behavior, which can be inaccurate and unreliable. Moreover, finding low incidence groups is no longer difficult and expensive since we can target shoppers based on their behaviors – telling you precisely the WHAT about shoppers, coupled with expertly applied custom research lets you understand the WHYS beyond their behaviors – giving you the holistic picture of the shopper If you’re interested in learning more about our new Illuminator Shopper Panel Powered by Prodege—or any other method to connect with shoppers—contact us. We’ll be happy to help you develop a customized plan to reach your target audience so you can continue to meet their needs in the post-COVID shopping world.

Erin Barber

President + Chief Client Officer, C+R Research

Terrie Wendricks